Table of Content

- Stop Waiting for a “Good Market”

- Why Dispatch Strategy Is the Deciding Factor in 2026

- Lane Discipline Beats Rate Chasing

- Rate Control Is a Skill, Not a Market Gift

- Cost Control Begins Before the Truck Moves

- Capacity Tightening Helps the Prepared, Not the Busy

- Why More Miles Is the Wrong Goal

- Final Thought

- Frequently Asked Questions

The 2026 trucking market will reward execution, not growth.

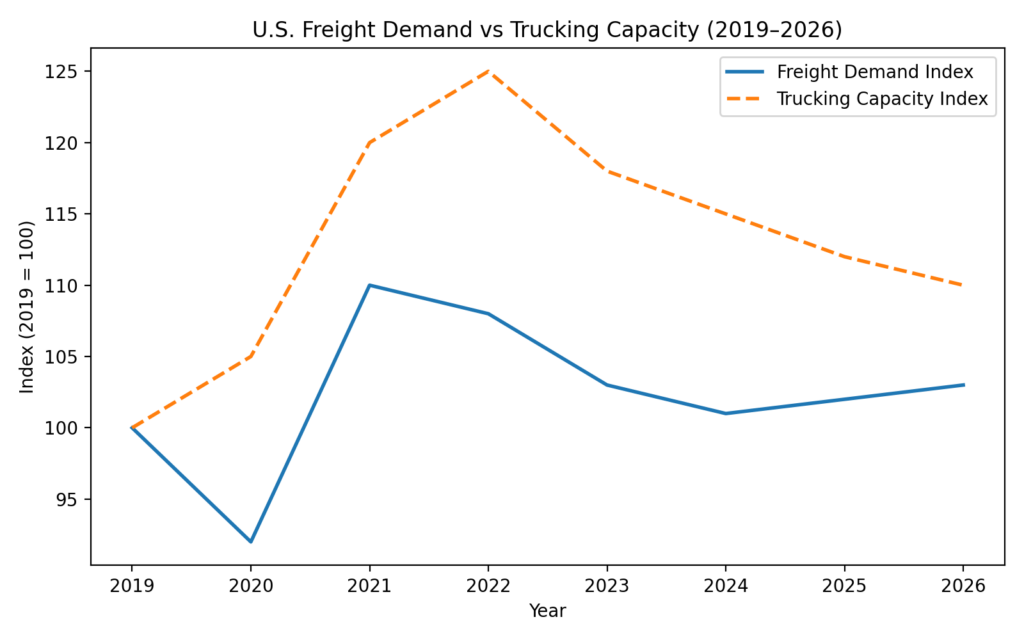

For single-truck operators, that execution shows up in one place: dispatch structure. Freight demand is stable but limited. Rates are improving unevenly. Capacity is tightening gradually. In this environment, profitability does not come from working harder. It comes from sequencing loads correctly, enforcing rate floors, and protecting cost per mile before the truck moves.

The trucking market entering 2026 is not collapsing, but it is no longer forgiving. Freight is moving, capacity is tightening gradually, and pricing strength exists only in specific lanes. In this environment, success does not come from waiting for a broad recovery. It comes from operating with precision.

This guide focuses on how owner-operators can win in the market as it exists today, not the one many hope will return.

Stop Waiting for a “Good Market”

Many owner-operators still view the freight cycle as something that eventually resets all problems. The assumption is that if they can survive long enough, conditions will return to a point where almost any load makes sense.

That assumption no longer holds.

Unlike previous recovery cycles, freight demand entering 2026 is not growing fast enough to mask operational mistakes. Retail inventory levels have largely returned to pre-pandemic norms, with inventory-to-sales ratios now hovering close to 2018-2019 averages after peaking sharply in 2022. Manufacturing output remains inconsistent, fluctuating around flat to low single-digit growth rather than sustained expansion. Import volumes, while off their post-pandemic lows, remain roughly 20-30% below the highs seen during the 2021 surge, limiting upside for port-driven truckload freight.

As a result, freight is available, but not abundant enough to lift rates across the board.

Operators who wait for a dramatic market shift often burn cash in the meantime. Those who adapt their operations to current conditions stay solvent long enough to benefit when the cycle eventually turns.

Why Dispatch Strategy Is the Deciding Factor in 2026

In looser markets, poor dispatch decisions are often hidden by volume. In tighter markets, the same decisions quickly destroy margin.

Dispatch in 2026 is no longer about keeping the truck moving at all costs. It is about protecting the business. Every load choice affects deadhead, maintenance cycles, cash-flow timing, and negotiating leverage on the next run.

Owner-operators who treat dispatch as a strategic function rather than a reactive task make fewer decisions, but better ones. They understand when waiting is cheaper than moving, when a lane is working, and when a rate is quietly subsidizing someone else’s freight.

That difference compounds over time.

Execution requires structure

Many owner-operators understand these principles but struggle to apply them consistently under real-world pressure. Decisions made late at night, between loads, or while chasing availability often undermine even the best planning.

In 2026, dispatch is not a back-office task. It is a risk-control function.

When lane discipline, rate floors, and reload planning are enforced consistently, variance drops. When decisions are reactive, variance compounds.

Structured dispatch support exists to protect decision quality under pressure – not just to find freight.

Learn how Logity Dispatch supports disciplined owner-operators →

Lane Discipline Beats Rate Chasing

One of the most common mistakes in the current market is jumping between regions in search of slightly better rates. While this can work briefly, it often leads to longer empty miles, weaker reload options, and unpredictable earnings.

Lane discipline creates stability. Operators who stay within familiar corridors understand true cost per mile, know where freight consistently reloads, and negotiate from experience rather than hope. Over time, this reduces deadhead, improves planning accuracy, and smooths cash flow.

In 2026, profitability is less about finding the highest-paying load and more about running lanes that reliably work.

Many operators learn the hard way that good loads don’t always create good weeks when sequencing, reload strategy, and empty miles aren’t controlled.

Rate Control Is a Skill, Not a Market Gift

Rates do not improve evenly for everyone. They improve first for operators who know their numbers and enforce them consistently.

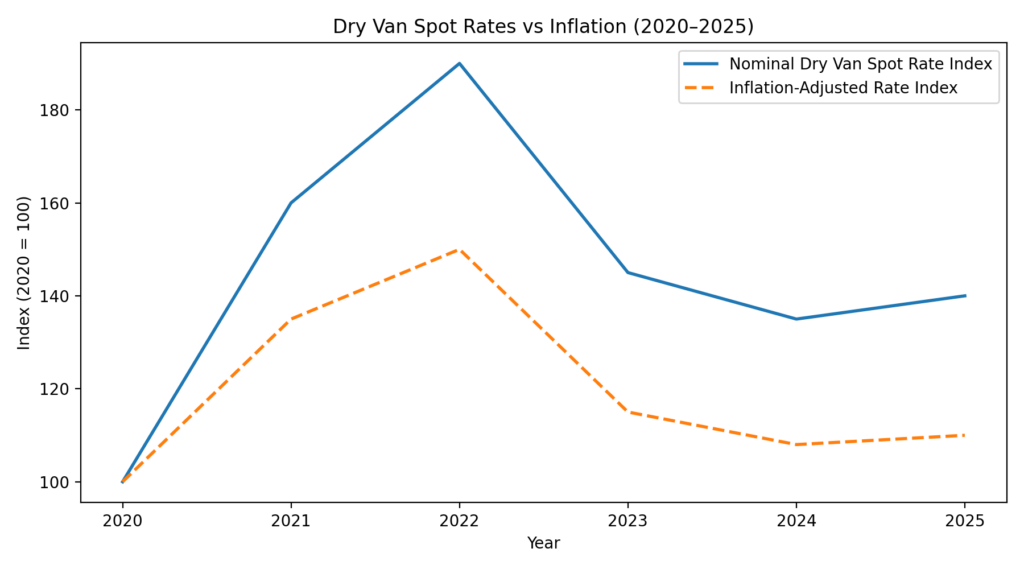

Even after late-2025 spot market improvements, truckload pricing remains well below inflation-adjusted peaks from the last cycle. During the 2021–2022 surge, many dry van spot lanes briefly exceeded $3.00 per mile on a nominal basis.

Adjusted for inflation, comparable pricing today would need to be meaningfully higher to match that purchasing power. Instead, many lanes entering 2026 continue to transact at levels that leave single-truck operators near break-even once insurance, maintenance, and financing costs are accounted for.

This is why rate discipline, not rate optimism, determines profitability in the current environment.

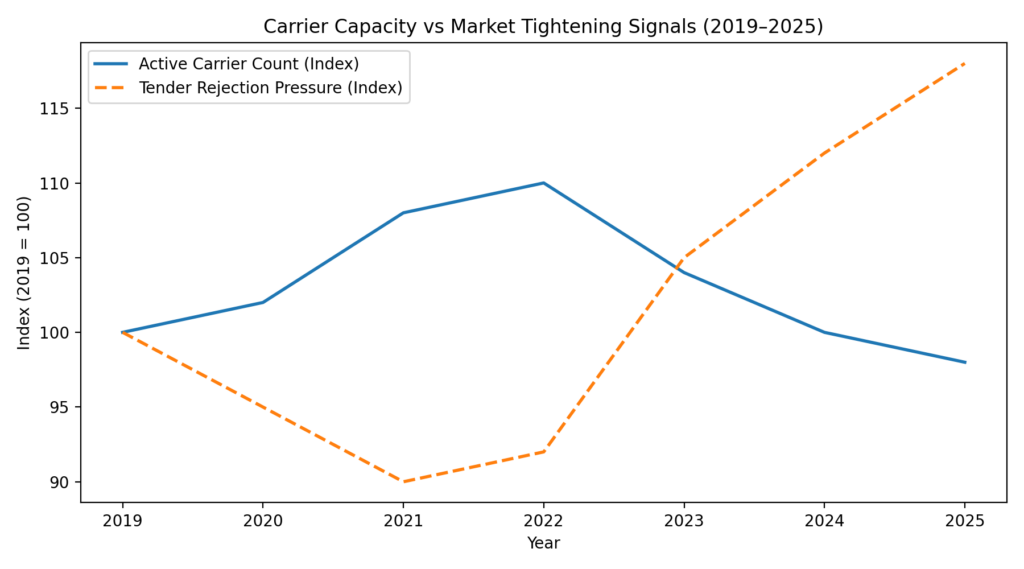

Owner-operators who accept weak freight “just to stay moving” often lock themselves into poor negotiating positions. Those who enforce realistic rate floors benefit first when capacity tightens.

Cost Control Begins Before the Truck Moves

Fuel prices fluctuate, but fuel is no longer the primary threat to profitability. The most dangerous costs in 2026 are insurance, financing, maintenance, and compliance.

For many owner-operators, non-fuel costs now represent the majority of operating expense. Insurance premiums alone have doubled or more compared to pre-pandemic levels for many small carriers, while equipment financing remains expensive. In this environment, small inefficiencies in dispatch decisions can translate into thousands of dollars in annual margin loss.

Poor load sequencing creates unnecessary miles. Inconsistent lanes increase wear and tear. Reactive scheduling leads to deferred maintenance and costly breakdowns. These losses accumulate quietly, often without being traced back to dispatch choices.

Understanding your real cost per mile starts with selecting the right freight, not reacting to what happens to be available.

Capacity Tightening Helps the Prepared, Not the Busy

As capacity continues to leave the market, many operators expect conditions to automatically improve. That only happens for those positioned to benefit from it.

While carrier exits since 2023 have reduced capacity, overall truck availability remains elevated compared to pre-pandemic norms. Registered carrier counts and tractor supply are still meaningfully higher than 2019 levels, reflecting how much capacity entered the market during the pandemic expansion. The tightening underway is real, but gradual. According to FMCSA registration data and ATRI operating cost benchmarks, active carrier counts remain significantly above 2019 baselines, while per-mile operating costs for small carriers continue to trend above historical norms.

This favors operators who are already running consistent lanes with predictable service. Those expecting a sudden shortage of trucks often see little improvement, even as headline data looks better.

Preparedness, not participation, determines who benefits first.

Why More Miles Is the Wrong Goal

Running more miles is no longer a reliable path to profitability. In many cases, more miles simply mean more deadhead, higher maintenance exposure, and thinner margins.

In the current cycle, better miles matter more than total miles. Fewer repositioning moves, predictable reloads, and tighter schedules do more for profitability than chasing utilization alone.

Many of the most stable owner-operators in 2026 will run less than they did in previous years, while keeping more of what they earn.

Logity Dispatch works with owner-operators who want structure in an unpredictable market. The focus is not on running more freight, but on running the right freight — consistently. That means disciplined lane selection, realistic rate floors, verified loads, and fewer reactive decisions between pickups.

For operators thinking beyond the next load, dispatch becomes part of risk management — not just load sourcing.

Consider a simple weekly comparison.

Operator A runs 3,100 miles with 420 empty miles at an average all-in rate of $2.20.

Operator B runs 2,650 miles with 150 empty miles at $2.35.After fuel, insurance, and maintenance allocation, Operator B often retains more net profit despite running 450 fewer miles.

The difference is not hustle. It is sequencing and reload planning.

Explore how Logity Dispatch works →

Final Thought

The 2026 trucking market does not require perfect timing. It requires operational clarity.

Owner-operators who approach dispatch as a system rather than a scramble position themselves to survive uncertainty and capitalize on opportunity when it appears. Longevity, not volume, remains the most underrated advantage in trucking.

And longevity is built one decision at a time.

Frequently Asked Questions

Is the trucking market expected to recover in 2026?

The market in 2026 is expected to stabilize rather than fully recover. Freight volumes are projected to grow modestly, generally in the low single digits, which supports baseline activity but does not create broad pricing power. Conditions may feel better than 2024–2025, but they will still reward disciplined operations rather than aggressive expansion.

Will trucking rates increase in 2026?

Rates are likely to improve unevenly by lane and equipment type rather than rising across the board. While some corridors may see stronger pricing as capacity tightens, overall spot rates remain below inflation-adjusted peaks from the last cycle. For most owner-operators, profitability will depend more on rate discipline than on market-wide rate increases.

Is 2026 a good year for owner-operators to expand their fleet?

For most small carriers, 2026 is better viewed as a year for balance-sheet repair than expansion. Financing remains expensive, insurance costs are elevated, and freight demand growth is limited. Operators who reduce risk, extend equipment life, and preserve cash flexibility are generally better positioned than those adding capacity.

How important is dispatch strategy in the current market?

Dispatch strategy is a defining factor in 2026. With limited margin for error, decisions around lane selection, rate floors, and load sequencing directly affect profitability. Owner-operators who treat dispatch as a strategic function rather than a reactive task tend to experience more stable earnings and lower operating stress.

Is capacity still leaving the trucking market?

Yes, capacity continues to exit gradually, particularly among undercapitalized carriers. However, overall truck availability remains higher than pre-pandemic levels due to the large influx of capacity during 2020–2022. This means tightening is real but slow, and benefits accrue first to operators who are already positioned correctly.

What are the biggest risks for owner-operators in 2026?

The primary risks include high insurance premiums, expensive financing, maintenance surprises, and weak load selection. In a low-growth environment, small operational inefficiencies can quickly compound into significant financial strain.

How can owner-operators protect margins in 2026?

Margin protection starts with disciplined dispatch. Running consistent lanes, enforcing realistic rate floors, minimizing deadhead, and avoiding reactive decisions are more effective than chasing volume. In the current market, fewer well-chosen loads often outperform higher mileage with weaker economics.