Owning a trucking business means doing far more than driving freight from point A to point B. Behind the wheel, you’re a driver — but off the road, you’re also the accountant, the marketer, the HR department, and the operations manager. For many small carriers and owner-operators, the hardest part isn’t finding loads, it’s keeping the money flowing when payments from shippers and brokers take weeks to arrive.

What is Freight Factoring?

At its core, the freight business is straightforward: pick up a shipment, deliver it to its destination, and send an invoice to the broker or shipper. Your earnings come from the difference between what you charge and the costs incurred to move the load.

The challenge is that payment doesn’t always come quickly. On average, brokers take about 40 days to pay, and in some cases, it can stretch to 90 days or more. For trucking businesses, that delay can create serious cash flow problems, making it hard to cover fuel, repairs, insurance, and other essential expenses.

Delayed broker payments become even more dangerous when drivers rely heavily on spot boards without structured planning.

This is where freight factoring comes in. Instead of waiting for your invoices to be paid, a factoring company buys them from you — usually at a small discount. In return, you get immediate cash, and the factoring company takes over the task of collecting payment from the broker. This approach keeps money flowing into your business, reduces financial stress, and allows you to focus on running your fleet instead of chasing payments.

How Freight Factoring Works

Freight factoring is designed to give trucking businesses quick access to cash for completed work, without waiting weeks for broker payments. The process is simple and straightforward:

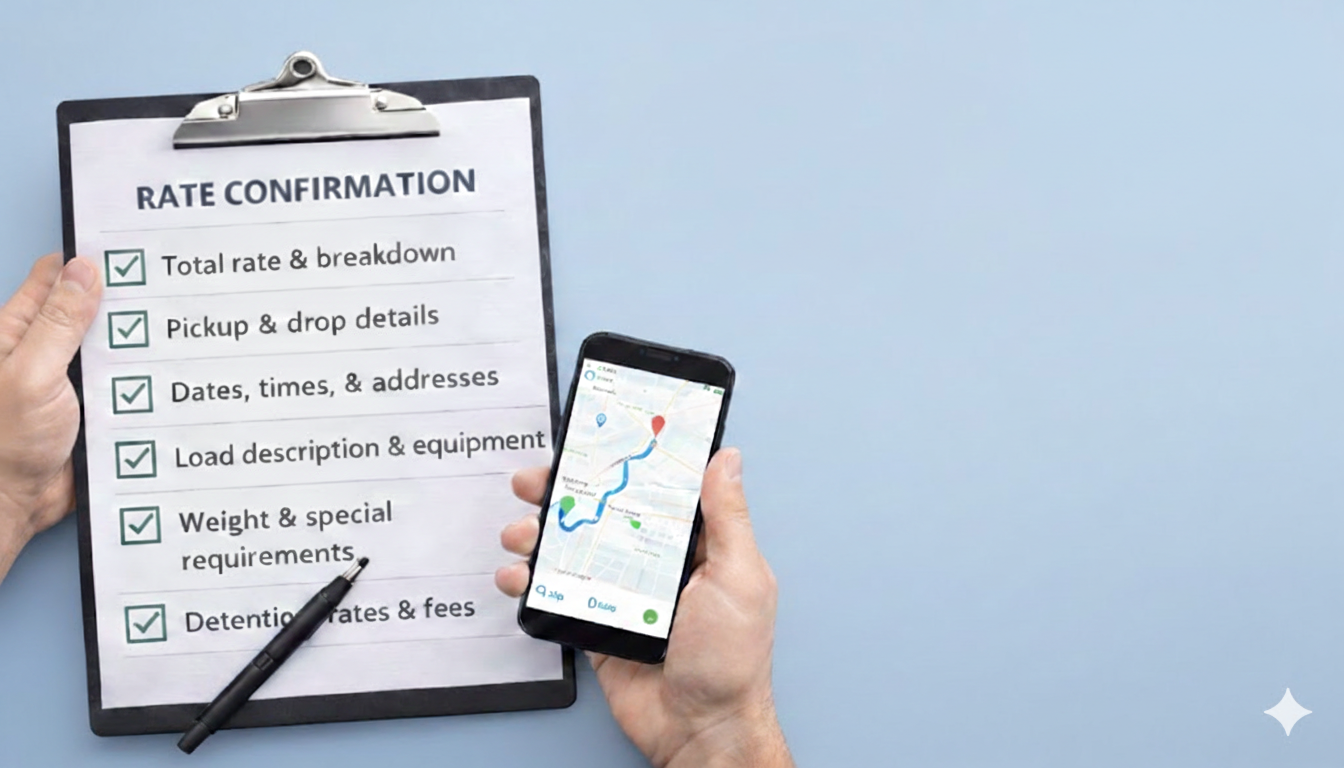

- Complete a delivery – you pick up a shipment, transport it, and drop it off at the destination.

- Send your paperwork – instead of sending your invoice to the broker, you submit it to a freight factoring company.

- Receive fast payment – once the invoice is verified, the factoring company advances most of the payment, often within 24 hours.

- Broker settles later – the broker eventually pays the factoring company on the normal terms, typically 30–45 days after delivery.

By letting a factoring company handle collections, you get immediate cash to cover operating expenses like fuel, maintenance, and payroll, while the company manages the wait for the broker’s payment. This keeps your business running smoothly and ensures you’re never left scrambling for funds.

What Does a Freight Factoring Company Do?

A freight factoring company acts as a financial partner for your trucking business, handling key aspects of your accounts receivable. Instead of waiting for brokers or shippers to pay you directly, the factoring company manages the invoicing and collections on your behalf. In exchange, they charge a small fee for their services.

Beyond simply advancing cash, many factoring companies also perform credit checks on brokers and shippers. This helps ensure you’re working with reliable partners and reduces the risk of nonpayment.

By outsourcing these financial tasks, a factoring company allows you to focus on what matters most: running your fleet, managing deliveries, and growing your business — without getting bogged down in paperwork or waiting weeks for payments.

The Benefits of Freight Invoice Factoring: Freight Bill Factoring

Freight invoice factoring offers several advantages that can help trucking businesses maintain financial stability and focus on growth. By converting outstanding invoices into immediate cash, factoring allows carriers to invest in their operations – whether that means expanding the fleet, enhancing service quality, or tackling day-to-day expenses – without being limited by delayed payments. Without operational structure, however, steady cash flow alone doesn’t guarantee consistent profit.

Fast access to cash

Once your invoice is approved, you can receive payment within 24 hours. This quick turnaround strengthens cash flow and provides working capital, which is vital for both small trucking companies and larger carriers.

Reduce accounting workload

Factoring companies handle your accounts receivable, effectively acting as an outsourced collections department. For a small fee, they take on tasks like sending invoices and following up on payments, freeing you from the time-consuming work of chasing down brokers. This allows you to focus on running your business instead of managing paperwork.

Broker vetting

Many factoring companies perform credit checks on brokers before advancing payment. This gives you an added layer of protection, ensuring you work with reliable partners even if you lack the time or resources to conduct these checks yourself.

Better financial forecasting

With guaranteed timely payments, forecasting becomes far easier. Knowing when cash will be available allows you to plan expenses, grow your business strategically, and stick to a realistic budget — especially important for new or expanding trucking factoring operations.

Freight invoice factoring streamlines cash flow, reduces administrative headaches, and provides peace of mind, making it a powerful tool for keeping your trucking business on the road and running smoothly.

Understanding Freight Factoring: Costs, Terms, and Eligibility

Before signing up with a factoring company, it’s crucial to know exactly what you’re getting into. Factoring can be a game-changer for cash flow, but the costs, rules, and requirements vary from provider to provider.

How Much It Costs

Factoring isn’t free. Most companies charge a fee between 2.5% and 5% per invoice, depending on the size and frequency of your loads. Some also tack on a small setup fee for your first invoice. Always factor these costs into your calculations so you know how each load affects your bottom line.

Factoring Options

There are two main approaches to freight factoring:

- Spot factoring allows you to choose which invoices to advance. This gives smaller carriers flexibility – they can factor a few loads when needed without committing everything.

- Contract factoring usually suits larger operations. With a contract, all invoices are factored under a negotiated rate, which often brings lower fees but requires a full commitment.

Who Qualifies

Not every trucking business can jump straight into factoring. Most providers require:

- A minimum credit score.

- At least three months in business.

- Documentation of revenue, or projected earnings for new companies.

- A short approval period before the first invoice can be advanced.

Drawing the Line

Freight factoring is more than just a financial tool — it’s part of a broader operational strategy. Cash flow stability only works when paired with disciplined load selection, strong broker relationships, and structured planning.

If you’re looking for a partner who helps you control both revenue flow and freight quality, explore our professional dispatch services designed specifically for owner-operators who want predictable growth.