Starting a trucking business requires substantial financial resources and personal savings to cover truck purchases and necessary equipment. This can also help manage ongoing fuel, insurance, and maintenance expenses. However, you can apply for grants for starting a trucking business to obtain financial assistance without the burden of repayment.

Government grants for starting trucking operations are designed to support entrepreneurs in the trucking industry and help them overcome financial challenges. The article reviews the top grant opportunities in the autumn of 2026, other available financial resources, and how to choose a suitable grant for your business.

While grants can help you launch your trucking business, long-term survival depends on disciplined operations, lane selection, and cost control. Many new authorities fail not because they lacked funding — but because they lacked operational structure.

What Are Trucking Business Grants?

Grants for starting a trucking business refer to financial resources provided by various organizations, such as government agencies, non-profit organizations, and private foundations. They aim to support entrepreneurs who seek to enter the trucking sector. Trucking grants offer funding to cover the initial investment for launching a trucking company. For instance, initial costs involve purchasing trucks, insurance coverage, fuel costs, or hiring new employees in some cases.

The biggest advantage of grants to launch trucking operations is that they do not need to be repaid as traditional financing, such as loans. Thus, grants are a more cost-effective way to launch your company without taking on debt.

Grants can come from various sources. Federal and state governmental bodies often provide grants to encourage economic development, create jobs, and support the growth of small businesses. Nonprofit organizations may also offer necessary funds to support specific groups, such as minority-owned businesses. Some private companies also provide funding for starting a trucking business as part of their corporate social responsibility programs.

Grants for starting trucking businesses can help offset the high upfront costs. This can reduce financial pressure and allow you to focus on growing your business.

Applying for trucking grants usually involves meeting certain criteria. This can include being a new business, fitting into a specific demographic category, having a detailed plan of business growth, or proving your commitment to sustainability or innovation.

Top 6 Grants to Start a Trucking Company in 2026

Choosing the right funding can be a key factor in the success of your business. It’s especially important in the trucking industry, where startup costs can be substantial. Grants for starting a trucking business can help you get on the road, covering initial costs for launching small businesses.

Here’s a breakdown of the top six grants to start trucking in 2026. Explore these options to find the best fit for you and take advantage of the available resources.

1. SBA 8(a) Business Development Program

The SBA 8(a) Development Program is an ideal resource for minority-owned and socially disadvantaged businesses. The program provides grants for starting a trucking business and offers mentoring, training, and access to government contracting opportunities.

To participate in this program, your business must be at least 51% owned by individuals who are socially or economically disadvantaged. The program focuses on giving underserved businesses a fair shot at federal contracts.

The 8(a) program can help trucking companies purchase vehicles, expand their fleet, or cover other initial costs. It ensures long-term support for up to nine years, providing access to the resources needed for sustained growth.

If you meet the qualifications, this is one of the top grants for starting a trucking company in the US.

2. FedEx Small Business Grant Contest

The FedEx Small Business Grant Contest is a competitive but rewarding opportunity for individuals who seek to start a trucking business. It awards cash prizes to a select number of small businesses each year, with the top prize totaling $50,000. In addition, winners receive FedEx shipping credits and print services that can help streamline operations and reduce costs.

To submit an application, businesses must detail their vision, while finalists must participate in a public voting round. If you don’t win, the exposure from participating can be valuable for promoting small businesses.

3. NASE Growth Grants

The National Association for the Self-Employed (NASE) offers growth grants suitable for small business owners. The program provides up to $4,000 in grants for starting a trucking business. These funds can be used for anything, from purchasing equipment to marketing or everyday expenses. This program is ideal for independent owner-operators and small trucking businesses that need extra financial support.

To apply, you must be a member of NASE and submit a detailed plan outlining how the grant will be used. The relatively smaller pool of eligible applicants and accessible entry criteria make this a great option for those seeking grants to start trucking operations.

4. Veteran-Owned Business Opportunities

Veterans who want to enter the trucking sector can access several specific grants through veteran-focused programs to start a trucking business. For instance, the US Department of Veterans Affairs and the Small Business Administration (SBA) offer grants, loans, and mentorship programs designed for veteran-owned businesses. These programs provide financial and technical assistance and resources to help veterans transition into a new sphere.

In addition to federal programs, many states and local governments offer grants for veteran entrepreneurs. These grants for starting a trucking company are tailored to veterans who want to enter new industries. This funding can cover initial investments like purchasing vehicles, setting up logistics software, and managing operational costs.

5. USDA Rural Business Enterprise Grants

The USDA Rural Business Enterprise Grant (RBEG) program is aimed at small businesses operating in rural areas. These grants for starting trucking businesses are intended to promote economic development in areas with fewer than 50,000 people, offering financial assistance to companies that provide services to rural communities. In the trucking sector, this can involve delivering goods, transporting agricultural products, or supporting local industries.

Received funds can be used to purchase trucks, build facilities, or train employees. If your trucking operations are in a qualifying area, the RBEG program is one of the best grant opportunities.

6. School Grants for Entrepreneurs

Some universities and educational institutions offer grants for starting a trucking business through their entrepreneurship programs. These grants are available to students or alumni who are starting a business. The funds can be used for a wide range of expenses, including acquiring vehicles or setting up operational systems.

School grants can be offered as part of business competitions or dedicated entrepreneurship funds. For instance, some institutions conduct competitions where students present their business ideas to a panel of judges for a chance to win funding.

This is an excellent opportunity to secure grants for a trucking company for a recent graduate or current student.

Other Financial Resources for Trucking Companies

While trucking grants can provide valuable startup capital, you can use other financial resources to manage cash flow and develop your business. SBA loans and fuel cards are essential tools for reaching the financial flexibility and operational support needed for a successful trucking business. These options also help cover initial expenses, offering more favorable funding options.

Before accepting your first loads, understand your true cost structure. We break this down in Get Your Primary Focus off of High-Paying Loads: Know Your CPM First.

SBA Loans

The Small Business Administration (SBA) offers different loan programs. They are designed to support small businesses. Loans provide access to capital at lower interest rates and more flexible terms than most traditional bank loans. Whether you’re launching a new business or plan to expand your existing operations, SBA can provide the necessary financial support.

The SBA loan programs include:

7(a) Loan Program. This is the SBA’s main loan option. In addition, it’s one of the most versatile options for initial funding. Trucking companies can apply for this loan to cover a wide range of expenses, including working capital, purchasing new trucks or trailers, or refinancing existing debt to improve interest rates.

The loan can total up to $55 million. The program also offers competitive interest rates and flexible repayment terms.

Microloan program. The SBA Microloan Program is a suitable option for smaller trucking businesses or owner-operators who need smaller funding. It provides loans of up to $50,000 to cover startup costs or purchase smaller assets, such as a first truck or software to manage small businesses.

Microloans also offer lower interest rates, making them ideal for new businesses that need a financial boost.

CDC/504 Loan Program. This is designed for long-term financing of major fixed assets. For trucking companies, it refers to warehouses, office space, or large commercial vehicles. The program provides long-term, fixed-rate financing. Depending on the project, the amounts range from $125,000 to $20 million.

The main benefit of the program is the possibility of making large investments in infrastructure or vehicle fleets while maintaining lower fixed interest rates.

Fuel Cards

Fuel is a major expense for trucking companies. Managing these costs is critical for maintaining profitability, especially for long-haul truck drivers or companies with larger fleets. Fuel cards are also vital for greater control and optimization of fuel expenses. With their discounts, real-time tracking, and nationwide convenience, they can optimize fuel costs and improve overall efficiency.

Their advantages include:

- Lower fuel prices. Many fuel card programs partner with specific gas stations or networks to offer discounted fuel prices. This can lead to significant savings in the long run. In addition, some cards offer rebates based on the volume of fuel purchased, providing further cost reductions.

- Expense tracking and reporting. Fuel cards can also help with tracking expenses in real time. They have detailed tracking features that allow companies to monitor fuel purchases made by their truck drivers, set spending limits, and generate reports. This helps manage the budget, forecast fuel costs, and identify potential ways of savings.

- Convenience and nationwide acceptance. Fuel card programs are accepted across the country. This coverage is beneficial for long-haul trucking businesses whose truck drivers need to refuel in different states. In addition, some fuel card programs offer roadside assistance, discounts on maintenance, and other benefits that can reduce operational expenses.

Is a Trucking Business Grant the Right Move for You?

Startup funding can reduce financial pressure in the early stages of launching a trucking company. However, a grant alone does not guarantee business stability.

Before applying for trucking startup grants, you should evaluate three operational factors:

Do You Have a 90-Day Cash Flow Plan?

Even with grant funding, new authorities face:

- Insurance down payments

- First-month fuel costs

- Maintenance reserves

- Delayed broker payments (30–45 days)

A grant may help with equipment or initial setup, but your business must still survive its first operating quarter. If you do not have a clear revenue forecast, cost-per-mile calculation, and working capital buffer, funding alone will not protect you.

Do You Understand Your Cost Structure?

Many new trucking businesses focus on “getting a truck” — not on understanding operating costs.

Before pursuing grant funding, calculate:

- Fixed costs (insurance, truck payment, permits)

- Variable costs (fuel, maintenance, tolls)

- Target revenue per mile

- Break-even point

If your cost structure is unclear, funding can accelerate losses instead of profitability.

Are You Prepared for Operational Execution?

Launching a trucking company requires more than capital. It requires:

- Lane selection strategy

- Broker vetting discipline

- Compliance management

- Dispatch coordination

- Market awareness

Grants are most effective when paired with structured operations. Funding without operational planning increases risk.

When a Grant Makes Strategic Sense

A trucking business grant is a strong option if:

- You qualify under specific eligibility programs (veteran, minority, rural)

- You have a detailed business plan

- You already understand your operating costs

- You plan to use the funding strategically (equipment, technology, compliance setup)

If these conditions are met, grant funding can reduce startup debt and improve long-term stability.

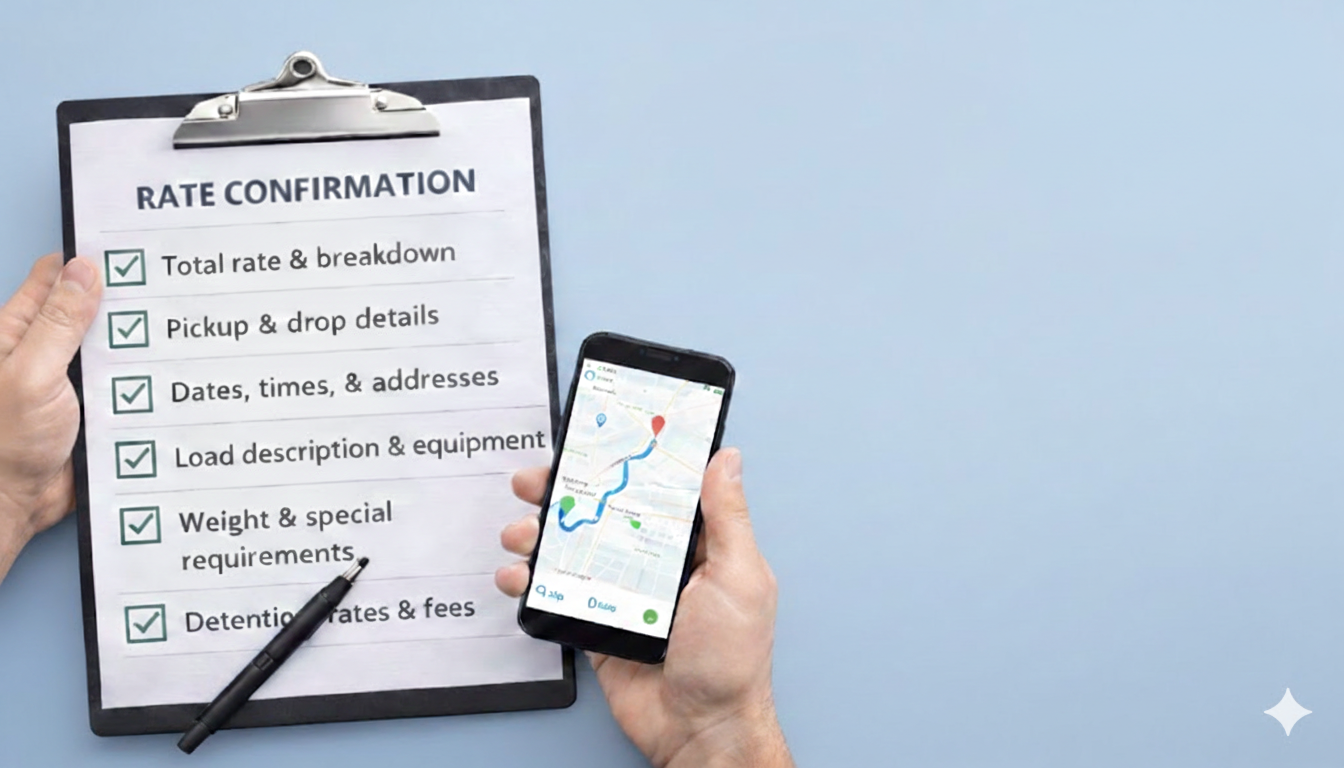

How to Apply for Trucking Business Grants

If you decide to apply for a grant to start trucking operations, you should understand how to do so effectively. You must be fully prepared, as the application process can be competitive. We’ve prepared a step-by-step guide to help you apply.

Identify the grant. Research different grant opportunities for starting trucking operations. Define those that match your business profile, whether that’s a veteran-ownd company, based in rral areas, or startup.

Launch a business plan. A well-prepared and developed plan is often required to receive a grant. This document should outline your mission, target market, services, and financial projections. It must also demonstrate how you plan to use the grant funds.

Prepare financial documentation. Some grants require detailed financial records, such as statements of current financial status and projections of business development. Be ready to demonstrate a clear picture of your finances.

Write a grant proposal. This is your chance to explain why your operations deserve funding. Be sure to emphasize the potential benefits your business will bring to the community, such as job creation or essential services providing.

Submit the application. When applying, follow the instructions carefully. This includes meeting the deadline and submitting required documents.

Follow up. As you submit your applications, you should follow up with the grant provider to confirm they receive your application. This demonstrates initiative and can keep your application at the forefront of your mind during the review process.

Be patient. Grant applications can take time, and not every application will be successful. If your first attempt doesn’t succeed, don’t get discouraged. There are many grants for starting a trucking business, and persistence can pay off.

Conclusion

Securing grants for starting a trucking busines can be a suitable way to reduce the initial costs needed for launching a new business. Despite the competitive and requiring application process, they can offer a unique opportunity to access non-repayable grant funding.

Many new authorities combine startup funding with professional dispatch support to avoid costly early mistakes. Explore our Owner-Operator Dispatch Services if you want structured freight selection from day one