Table of Content

- When a “Good Load” Starts Falling Apart

- Double Brokering: The Risk You Discover After Delivery

- When the Marketplace Itself Works Against You

- Regulation Is Catching Up – Slowly

- A More Stable Way to Run Freight

- The Real Cost to Consider

- Operational stability doesn’t come from access – it comes from structure

Load boards are often sold as freedom. Open an app, scan available freight, book a load, and keep moving. For many owner-operators navigating today’s unpredictable market, they feel like control — no contracts, no long-term commitments, just access.

And to be fair, that access is useful. Load boards can help fill gaps between runs, cover short hauls, or keep wheels turning during slower weeks.

But for drivers who rely on them day after day, a different reality tends to emerge. Missed payments. Loads that vanish after deadhead miles are already burned. Brokers who stop answering calls once delivery is complete. Freight posted multiple times at different rates. Hours lost refreshing screens instead of driving.

These aren’t rare sad stories. They’re structural risks built into how open freight marketplaces operate.

Industry data backs up what drivers are experiencing.The American Transportation Research Institute (ATRI) consistently finds that owner-operators rank broker-related issues – including rate pressure, payment delays, and lack of transparency – among their most serious challenges, alongside fuel and equipment costs. In practice, many of these broker problems surface most often when freight is sourced through open load boards, where verification gaps and limited oversight are common.

Understanding these hidden costs isn’t about avoiding load boards entirely. It’s about knowing what you’re exposed to when they become your primary source of freight.

When a “Good Load” Starts Falling Apart

Most problems don’t begin with obvious red flags.

A posting looks clean. The rate is reasonable. The broker answers quickly. Everything feels routine – until it isn’t.

Sometimes the shipper has no record of the broker listed on the rate confirmation. Sometimes the DOT number doesn’t align with what’s shown in FMCSA’s public database. Sometimes the load is suddenly “canceled” only after a driver has already driven 60 or 80 empty miles to the pickup. Those repositioning moves may seem minor in isolation, but over time empty miles quietly drain profit in ways many operators underestimate.

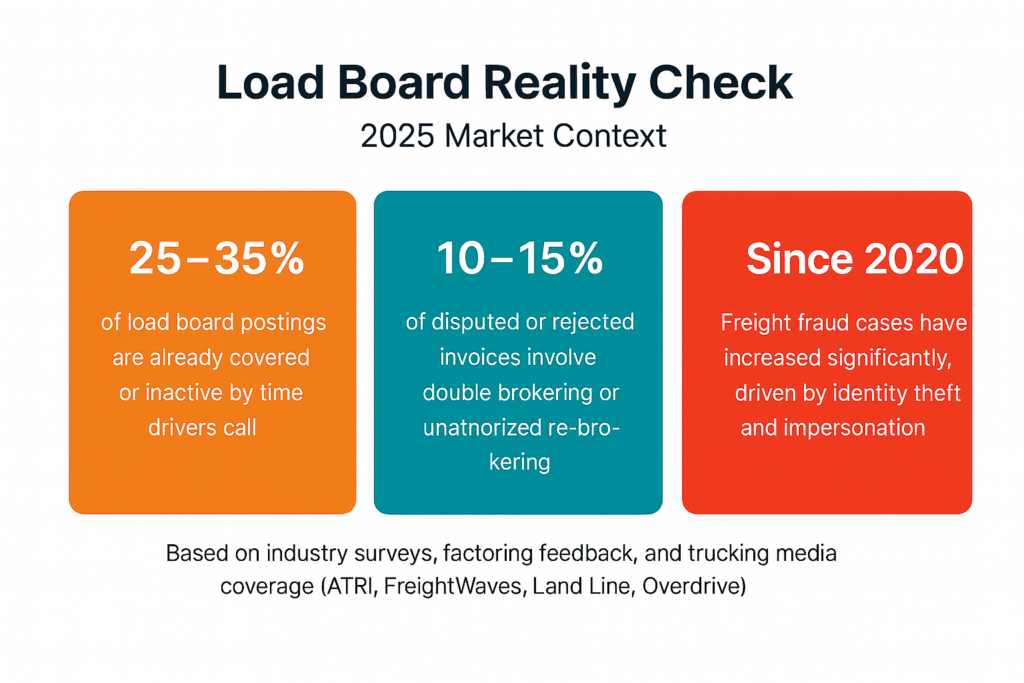

Freight fraud has become more sophisticated in recent years. Industry reporting from shows that reported freight fraud incidents have multiplied several times since 2020, driven largely by identity theft, impersonation schemes, and digital manipulation tied to load board activity. Scammers now rely on stolen broker identities, cloned rate confirmations, spoofed phone numbers, and professional-looking email domains that closely mimic legitimate companies.

To a driver on the road, these schemes often look completely normal.

In more serious cases, criminals impersonate carriers themselves – booking loads, picking up freight, and disappearing under stolen credentials. These incidents leave legitimate drivers dealing with investigations, claims, and reputational damage even when they did nothing wrong.

By the time most drivers realize something is off, the loss has already occurred: fuel spent, time lost, freight compromised, and sometimes personal or business information exposed.

Double Brokering: The Risk You Discover After Delivery

Some of the most damaging problems don’t surface until the job is finished.

A driver books the load, runs it clean, submits paperwork – and then receives a call saying the broker who hired them never actually had the freight. The original broker demands answers. Payment is frozen. Everyone starts pointing fingers.

This is double brokering, and it has become increasingly common in the spot market. Dispatch offices and factoring companies report that roughly 10–15% of disputed or rejected invoices now involve some form of double brokering or unauthorized re-brokering. These cases are most frequently tied to spot loads sourced through open marketplaces, where freight can pass through multiple hands before pickup.

From the driver’s perspective, the damage is simple and severe. The miles were run. The fuel was paid for. The hours were invested.

And the paycheck never comes.

Load boards don’t absorb that loss. Drivers do.

When the Marketplace Itself Works Against You

Even when freight is legitimate, the mechanics of load boards can quietly undermine profitability.

In many regions, there are far more trucks than posted loads. That imbalance turns booking into a race. Brokers know that if one driver hesitates, another will accept a lower rate. Negotiating power disappears quickly.

At the same time, posted freight often doesn’t reflect real-time availability. Industry analyses and carrier surveys suggest that roughly 25–35% of load board postings are already covered or no longer available by the time a driver calls. In plain terms, that means about one out of every three calls leads nowhere – not because of poor timing, but because the load was never truly available in the first place.

Duplicate postings and stale listings further cloud visibility, forcing drivers to waste time chasing freight that no longer exists.

Seasonal slowdowns add another layer of pressure. During softer freight cycles, spot volume contracts while truck counts remain high. ATRI surveys and carrier studies consistently show that owner-operators who rely primarily on spot-market freight experience significantly higher week-to-week income volatility than those running consistent lanes or vetted broker relationships.

What looks like flexibility on paper often feels like constant reaction mode behind the wheel.

The risks of load boards aren’t only physical or financial. They’re digital too.

Trucking-focused security reporting from platforms like Truckstop, has documented a sharp rise in cyber incidents affecting small carriers. These attacks often begin with phishing emails, compromised login credentials, or fake broker communications tied directly to load board activity.

In some cases, criminals gain access to carrier profiles or FMCSA-related information, redirect payments, or impersonate legitimate businesses. Even dispatch tools and ELD-related systems can become entry points if credentials are exposed.

A single breach can disrupt operations for days, delay settlements, and force drivers to spend valuable time repairing damage instead of running freight.

That risk doesn’t come from load boards alone, it comes from not knowing who’s actually behind the freight. Knowing how to verify freight partners before you roll is becoming a basic survival skill for owner-operators.

Cyber risk isn’t a big-fleet problem anymore. It’s part of everyday reality for independent operators.

Regulation Is Catching Up – Slowly

Federal regulators are responding to many of these issues. FMCSA has acknowledged widespread carrier complaints through upcoming broker financial security and transparency rules designed to reduce nonpayment risk and improve access to transaction records.

These changes are meaningful. But they don’t eliminate the day-to-day exposure drivers face in open spot markets. The responsibility for verifying brokers, protecting payment, and avoiding bad freight still falls largely on the carrier.

In other words, regulation helps – but it doesn’t remove the hidden costs.

A More Stable Way to Run Freight

After enough close calls, many owner-operators reach the same conclusion: relying entirely on load boards means spending too much time defending against problems that shouldn’t exist in the first place.

That’s why more drivers are moving toward guided dispatch and vetted freight relationships – setups where loads are screened before booking, brokers are verified, and someone is actively watching for issues instead of reacting after the fact.

At Logity Dispatch, the goal isn’t to flood drivers with listings. It’s to reduce surprises.

That means verifying brokers, avoiding high-risk patterns, minimizing exposure to double brokering, and helping drivers focus on real miles instead of constant problem-solving.

When freight is vetted and decisions are supported, stress drops. Cash flow stabilizes. And drivers regain control of their time instead of living inside load board refresh loops.

The Real Cost to Consider

Load boards aren’t inherently bad. But the risks tied to them are real – and increasingly common.

Fraud incidents have multiplied over the past few years. Up to a third of posted loads may already be gone before a driver ever calls. A meaningful share of invoice disputes now stem from double brokering. Spot-market dependence brings higher income volatility and more operational stress.

Ignoring those realities doesn’t make them disappear.

Running smarter today isn’t about chasing every available load. It’s about choosing systems and partners that reduce risk before it reaches the truck. Many operators learn the hard way that good loads don’t always translate into good weeks when freight isn’t sequenced or vetted strategically.

Owner-operators deserve predictability, fair pay, and support that protects their business – not just access to another list of freight.

That’s the difference between staying busy and staying in control.

Operational stability doesn’t come from access – it comes from structure

Relying on open marketplaces means constantly reacting: verifying brokers, chasing confirmations, absorbing deadhead, and hoping today’s load doesn’t become tomorrow’s problem. For many owner-operators, the real cost isn’t just lower rates – it’s time, focus, and predictability lost to systems that weren’t designed to protect the carrier.

Some operators reduce that exposure by working with dispatch partners who filter freight, verify brokers, and align booking decisions with cost-per-mile realities – instead of leaving every decision to the spot market.

Logity Dispatch works with owner-operators who want fewer surprises, cleaner freight flow, and decisions that protect margins before the truck moves.