Truck drivers often have significant work-related expenses, from fuel and maintenance to meals and travel. During tax season, many drivers look for ways to reduce their tax burden by understanding which expenses may be deductible.

Tax deductions for truck drivers depend heavily on employment status and individual circumstances. This article provides a general overview of common deductions that owner-operators and self-employed drivers often ask about.

Eligibility for truck driver tax deductions depends on how you are classified. W-2 company drivers generally cannot deduct unreimbursed job expenses under current U.S. tax law. Most deductions discussed below apply to self-employed drivers and owner-operators who file taxes using Schedule C.

Truck drivers can benefit from a comprehensive tax deduction list, including expenses such as fuel costs, maintenance, insurance of the vehicle. Keeping meticulous records of these expenses is crucial for claiming the truck driver expenses for taxes.

To ensure a smooth tax season, self-employed truck drivers should use a 1099-NEC and maintain detailed records of income and expenditures. This information is necessary for filing Schedule C and Schedule SE alongside their Form 1040 tax return. By staying informed about tax benefits for truck drivers and understanding the truck driver tax deduction list, individuals can make the most of available deductions and reduce their overall tax liability.

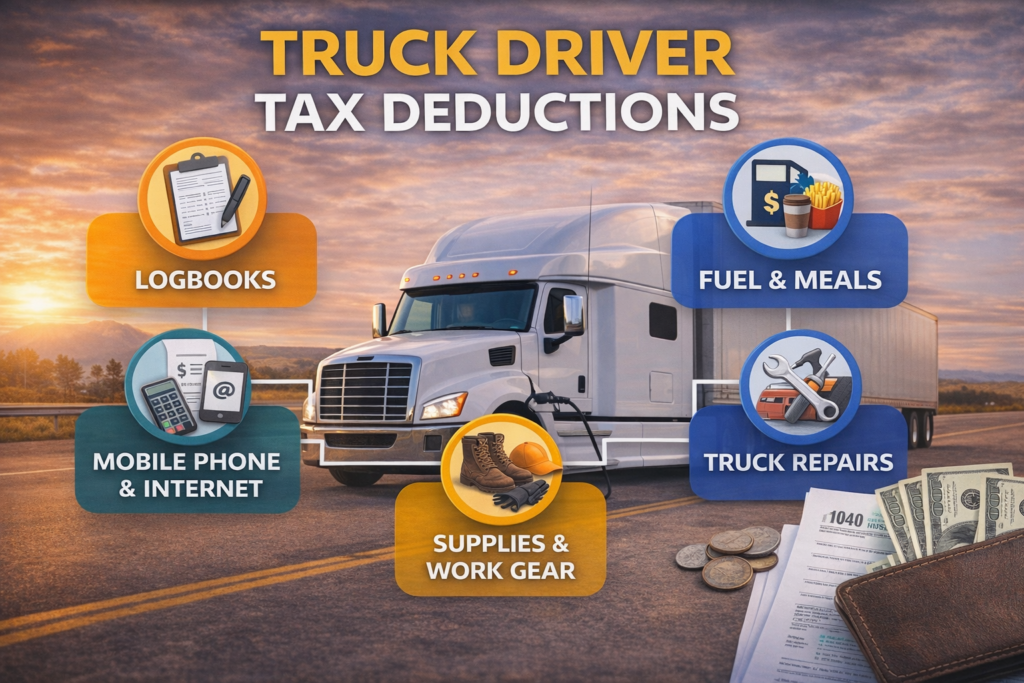

Common truck driver tax deductions

The following are commonly discussed deductions for self-employed truck drivers. Whether an expense is deductible depends on how it’s used, documented, and reported.

- Association Dues: Deduct fees required for union or trucking association membership if essential for business.

- Cell Phone/Computer: 100% deductible if used exclusively for work; partial deduction if used for both business and personal purposes.

- Clothing: Deductible for specialized work-related clothing and safety gear, not for everyday wear.

- Education: Deduct training expenses for obtaining or maintaining a CDL license or other required certifications.

- Tools and Equipment: Deductible expenses for necessary tools and equipment, such as chains, tarps, and ratchet straps.

- Insurance: Deduct premiums for commercial auto liability, property damage, cargo, and health, dental, and vision insurance.

- Meals: Deductible for overnight stays away from the tax home, with options for actual expenses or per diem allowance.

- Travel Costs: Deductible expenses include accommodations, tolls, and parking during overnight stays away from the tax home.

- Medical Exams: Deduct out-of-pocket costs for required medical exams related to the job.

- Office Expenses: Deduct traditional office expenses like postage, paper, calculators, and accounting software.

- Personal Products: Deduct smaller purchases such as coolers, flashlights, GPS devices, and bedding.

- Subscriptions: Deduct the full cost of subscriptions to trucking-related publications.

- Taxes and Licenses: Deduct business-related taxes and license fees, including Heavy Highway Vehicle Use Tax.

- Vehicle Expenses: Deduct all actual expenses for operating a semi truck, including depreciation, fuel, insurance, and maintenance.

Managing deductions goes hand in hand with staying compliant. Drivers should also understand key DOT compliance rules that affect record-keeping and audits.

Expenses that aren’t deductible include everyday wear clothing, commuting costs between home and business headquarters, home phone line expenses, reimbursed expenses, and personal trip-related expenses.

Ultimately, the key to deductible expenses lies in their necessity for business and maintaining proper records. Rigorous record-keeping, including receipts and documentation, is crucial for successfully claiming deductions on the tax return.

Staying Organized as an Owner-Operator

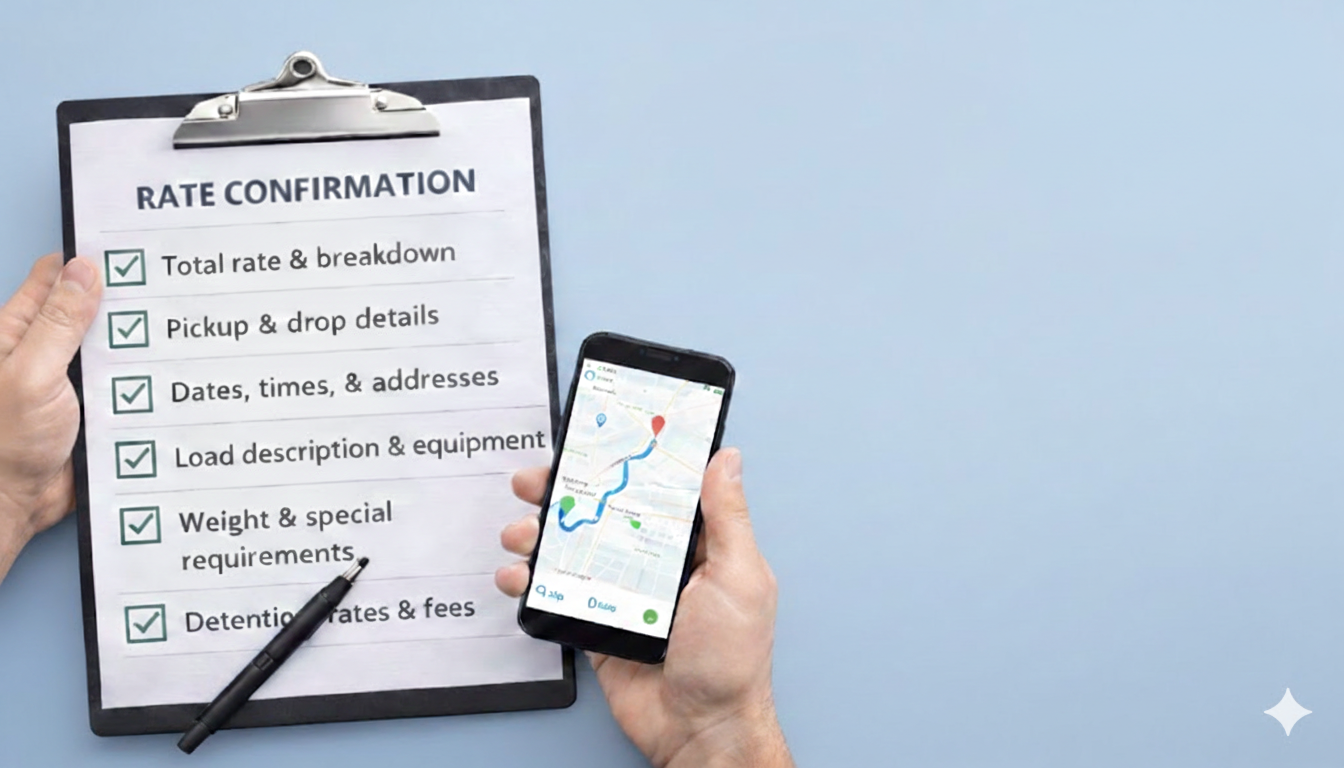

Managing tax deductions is easier when your records are consistent throughout the year. Clean mileage logs, load history, fuel receipts, and IFTA data all play a role in making tax season less stressful.

Dispatch support can help owner-operators stay organized by keeping weekly operations structured which naturally leads to cleaner paperwork and fewer missing records. When your loads, miles, and invoices are tracked consistently, it’s easier for your accountant or tax preparer to work with accurate information.

Staying organized isn’t about tax strategy, it’s about running your business in a way that doesn’t create chaos later.