The 2025 regulatory calendar isn’t just about compliance – it will directly affect how carriers price loads, spec equipment, manage drivers, and plan lanes. From safety technology mandates to emissions standards, upcoming rulemakings will influence operating costs and day-to-day decision-making across the trucking industry.

Understanding these regulatory changes is essential for staying compliant and competitive in an evolving industry. For owner-operators and small fleets, regulatory shifts often show up first as cost changes, equipment requirements, or tighter operating margins – not just paperwork.

The article outlines the most critical updates, from the federal motor carrier safety regulations to new environmental policies.

Key Regulations to Look Out For

As the regulations governing the trucking industry continue to evolve, trucking companies, motor carriers, and truck drivers face a range of new rules. These rules aim to improve safety on the road, compliance, and environmental stability. New trucking laws are expected to have a far-reaching impact on the way commercial vehicles are operated, managed, and inspected.

From updates on electronic logging devices (ELDs) to the potential mandate for automatic emergency braking (AEB) systems, drivers and other industry professionals must stay updated about new regulatory changes to remain compliant and competitive.

As the industry prepares for these regulatory changes, trucking companies must stay ahead of the curve. By understanding and complying with these upcoming changes, carriers can maintain a competitive edge while prioritizing safety and operational efficiency.

Speed Limiters for Heavy Trucks

The Federal Motor Carrier Safety Administration (FMCSA) proposed a rule to oblige commercial motor vehicles over 26,000 pounds to be equipped with electronic control units (ECUs). They will restrict the maximum speed of trucks. The aim is to enhance safety on the road, reducing high-speed crashes.

Opinions on the issue are mixed. For example, the Owner-Operator Independent Drivers Association (OOIDA) opposes the regulations because they may disrupt traffic and increase crashes. At the same time, the Truckload Carriers Association (TCA) suggests flexibility and recommends speed limits between 65 and 70 mph.

Despite the uncertain results, the proposed rule is on the horizon. Thus, truck drivers must be prepared to face new regulations. Changes that affect transit time and routing make weekly planning more important than simply selecting loads based on rate alone.

Heavy Vehicle Automatic Emergency Braking (AEB)

One of the upcoming trucking regulations is a proposal to require automatic emergency braking (AEB) systems on new heavy commercial vehicles. The rule defines heavy trucks as those with a gross vehicle weight of over 10,000 pounds.

AEB system uses sensor technologies to detect impending crashes. In this case, the system automatically applies the brakes if the driver has not.

This update can be crucial for the trucking industry’s safety by reducing incidents on the nation’s roadways. According to the National Highway Traffic Safety Administration (NHTSA), heavy vehicles are involved in around 60,000 rear-end crashes yearly. The estimates forecast the prevention of 19,118 crashes in case of the rule implementation.

The AEB system update was proposed last year, and the final rule is expected in January 2025.

Electronic Logging Devices (ELD) Expansion

The FMCSA is expanding its oversight of electronic logging devices (ELDs) that track drivers’ service hours. ELD requirements are part of a Hous of Service (HOS) rules that aim to enforce safe driving limits and improve compliance with trucking regulations.

The expansion aims to include more vehicles, particularly vehicles weighing over a specified threshold. In particular, there are five areas where the Federal Motor Carrier Safety Administration considers changes:

Applicability to pre-2000 engines.

Addressing ELD malfunctions.

The process for removing ELD products from FMCSA’s list of registered devices.

Technical specifications.

ELD certification.

These systems will facilitate the collection of roadside inspection data and provide a real-time view of compliance with safety and operational standards as part of the new trucking laws.

Drug and Alcohol Clearinghouse Updates

The drug and alcohol clearinghouse is essential for ensuring truck drivers comply with drug and alcohol regulations. New rules are expected to tighten requirements. The goal is to strengthen monitoring and support safety data tracking to prevent unsafe drivers from returning to the road, protecting drivers and the public.

In particular, the FMCSA will revoke the CDL of commercial drivers with the prohibited status amid their past drug or alcohol violations. These drivers will be required to complete the federal return-to-duty process for further operations. This involves an interview with a DOT-Qualified Substance Abuse Professional (SAP), completion of an education or treatment program, and a return-to-duty drug and alcohol test. Then, the follow-up program must include a minimum of six unannounced drug and alcohol tests over the next 12 months.

The rule demands that states comply with the new system from November 2024, while the full extent of the rule will take effect in 2025.

In addition, the Substance Abuse and Mental Health Services Administration (SAMHSA) proposes to launch scientific and technical guidelines for including hair specimens in drug testing programs. The SAMHSA is currently seeking public comments on the rule.

Fuel Standards for Medium- and Heavy-Duty Vehicles

Fuel standards for medium and heavy-duty vehicles are also tightening. The National Highway Traffic Safety Administration proposed rulemaking to lower greenhouse gas emissions and improve truck fuel efficiency.

New regulations will affect motor carriers’ and fleet operators’ operations. They must comply with stricter technical specifications for vehicle performance, emissions systems, and equipment.

As equipment standards evolve, understanding your real operating cost becomes critical before accepting freight in changing markets.

New regulations will cover heavy-duty trucks from 2014 models, requiring an increase in fuel efficiency from the current average of 6 to 8 miles per gallon. The Environmental Protection Agency (EPA) projects a 250-ton reduction in carbon emissions within the first five years. In addition, the new rule will reduce fuel costs for small businesses that depend on pickups and heavy-duty vehicles.

The regulation is expected to take into force in June 2025.

Operational Planning in a Changing Regulatory Environment

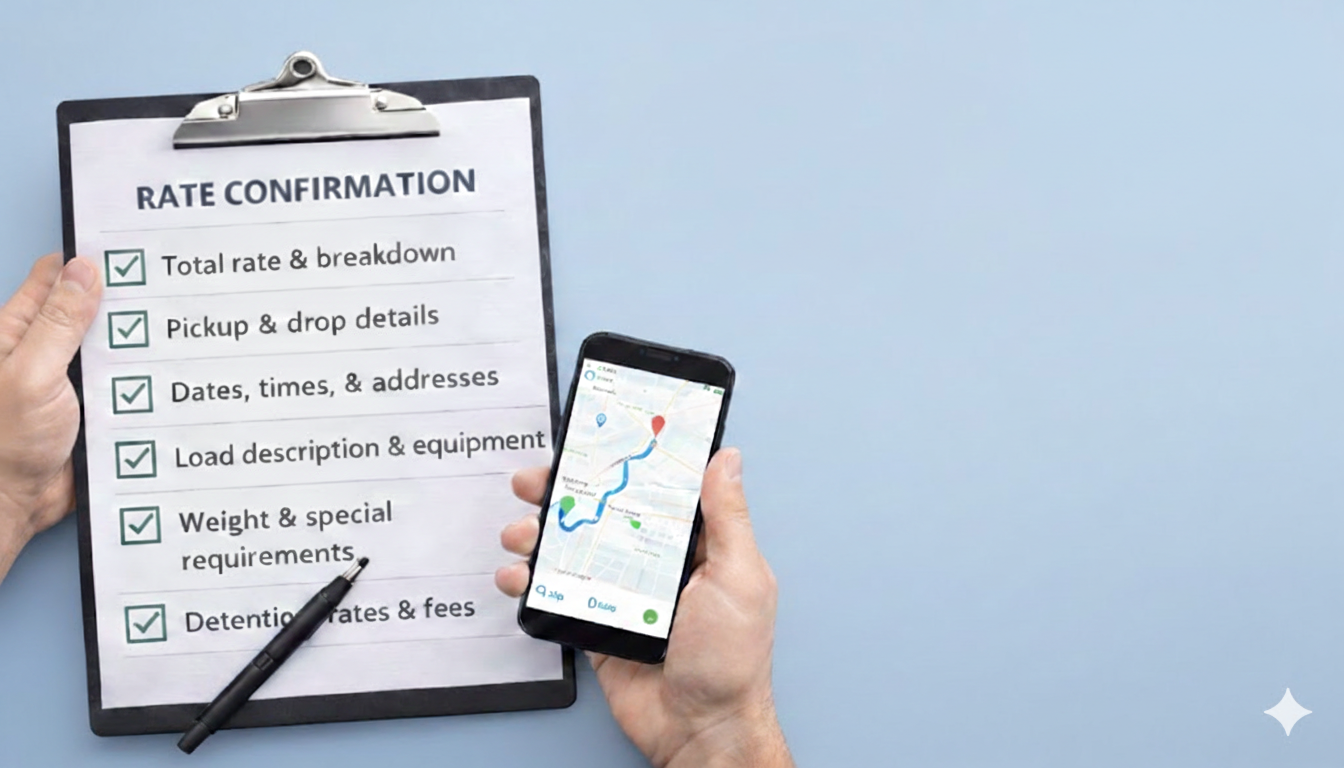

As regulations evolve, many carriers are reassessing how they plan routes, select freight, and manage compliance requirements alongside daily operations. Structured dispatch planning, documentation tracking, and better lane visibility help reduce disruption when new mandates take effect.

Conclusion

Regulatory change is becoming a constant in trucking rather than an occasional adjustment. Carriers that monitor rulemaking early – and adapt their cost structure, equipment strategy, and operating patterns accordingly – will be better positioned to avoid disruption.

In 2025, compliance will no longer be separate from operations. It will be part of how profitable carriers plan freight, manage risk, and stay competitive in a more structured environment.